Upbit’s Bitcoin Stacking Strategy

— The Sustainability of Upbit’s Bitcoin DCA and Its Valuation Implications

TL;DR

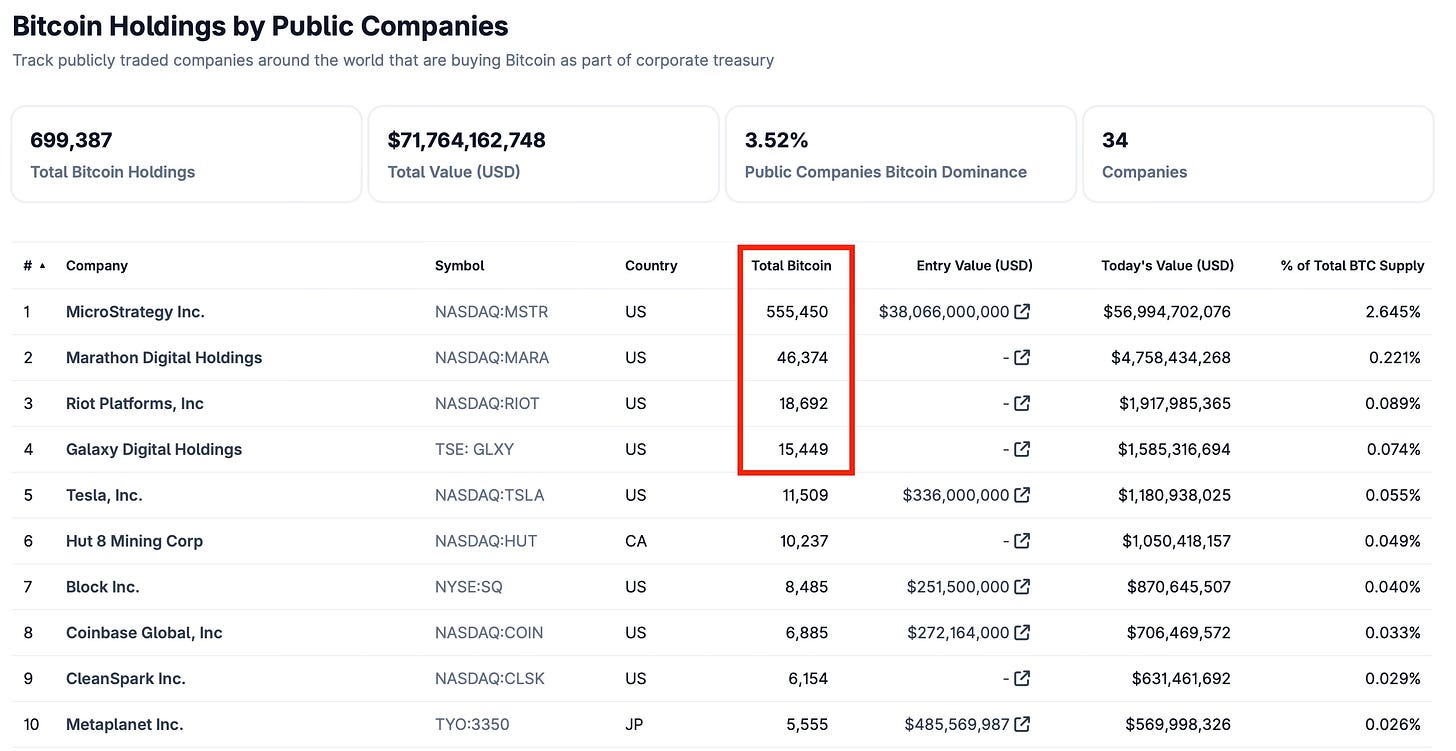

Dunamu Inc., the operator of the cryptocurrency exchange Upbit, has rapidly accumulated 16,839 BTC as of the end of December 2024 through a de facto Dollar-Cost Averaging (DCA) strategy, funded by revenue from “BTC market trading fees” and “BTC withdrawal fees.” Valued at approximately USD 1.8B, this positions Dunamu 4th globally among publicly listed companies and 10th including private companies in terms of Bitcoin holdings.

However, due to a structural decline in BTC market trading volume—driven by a growing market sentiment of Bitcoin as a Store of Value—and expected pressure on withdrawal fee profitability due to intensifying competition among exchanges, it is unlikely that Dunamu will be able to maintain its previous pace of Bitcoin accumulation.

Regulatory clarity—such as the phased approval of corporate accounts—suggests that Dunamu may gain more flexibility in how it disposes of its Bitcoin holdings. This could result in strategic shifts of Dunamu, making it important to closely monitor their BTC-related decisions.

Valuation Comment :

While there are many reports on Dunamu's operating and net profits, few have covered its Bitcoin holdings or how Upbit’s revenue model is tied to BTC. The market may be undervaluing this component. (Not financial advice.)

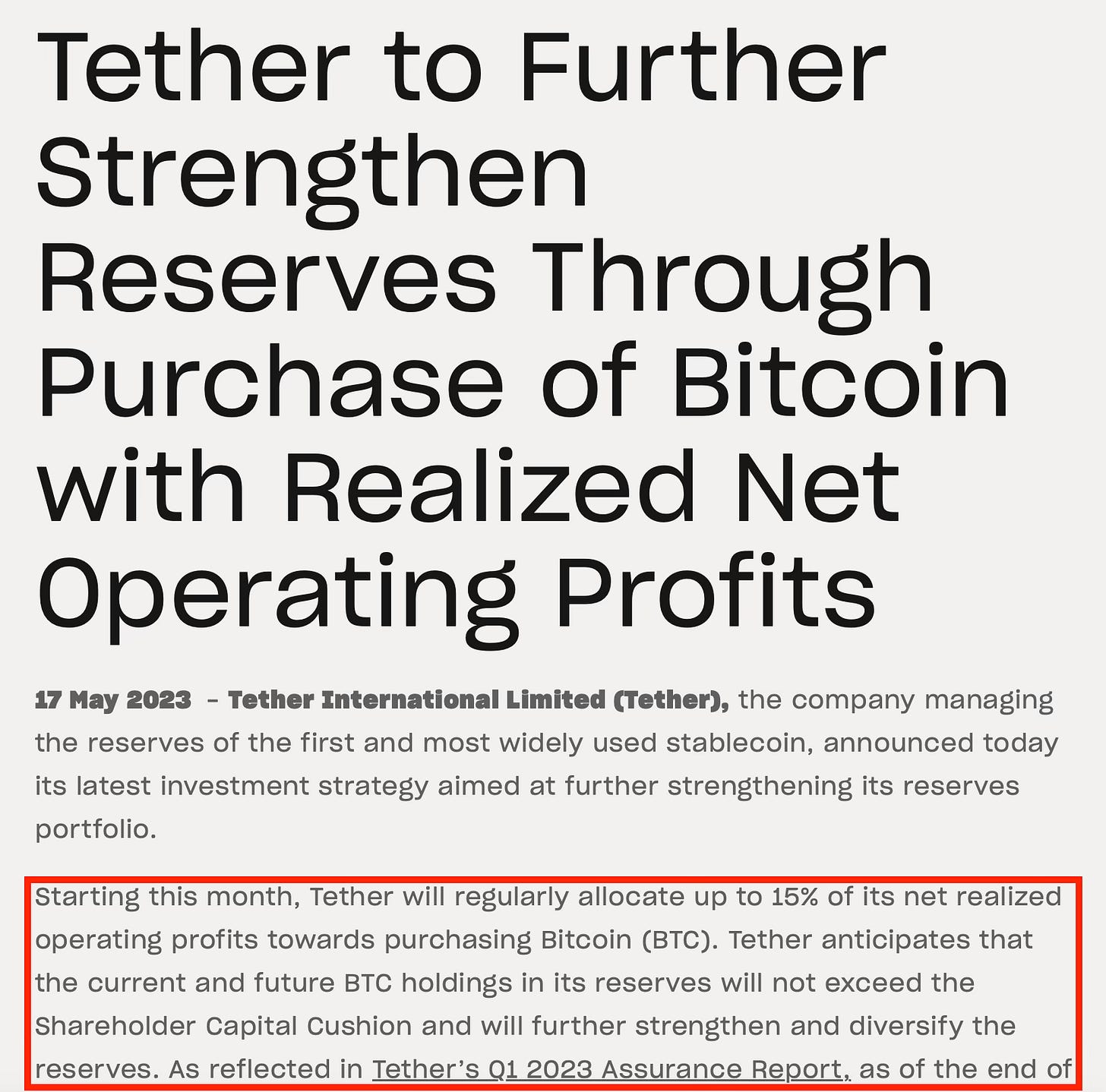

In particular, the USD 1.1B increase in equity due to revaluation of intangible assets (Bitcoin) at the end of 2024 is not reflected in operating or net income, and may be overlooked by general investors. This revaluation is also not yet priced into Dunamu’s current market cap of USD 3.9B when adjusting for PER.

Coinbase may seem like a natural comp, but its broader business scope—such as its Base chain, Deribit options, and expected futures expansion in the U.S.—extends beyond Upbit's current operations. Still, the discrepancy in adjusted PERs when accounting for Bitcoin reserves could be a meaningful consideration for investors.

However, it's equally important not to overvalue Dunamu based on the assumption of continued BTC accumulation. Given the recent market and fee trends, maintaining that pace seems unlikely.

Reference :

Table of Contents

1. Bitcoin’s Rise as an Asset Class and the Emergence of Stacking Corporates

2. Dunamu’s Bitcoin Reserves and Its Revenue Sources

3. Future Outlook for Upbit’s BTC DCA

4. Conclusion

1. Bitcoin’s Rise as an Asset Class and the Emergence of Stacking Corporates

With Bitcoin spot ETFs approved in the US and expectations of crypto-friendly policies under a potential Trump administration 2.0, Bitcoin is once again hovering near its all-time high.

15 years after the January 2009 Genesis block of Bitcoin, It has gained recognition as an alternative asset class through US spot ETF approval - where could it go in another 15 years? The answer varies depending on one's belief in the vision of digital finance implemented through distributed ledger technology.

While the spot ETF approval represents social recognition of Bitcoin as a working distributed ledger software/hardware architecture that prevents digital double-spending beyond just concept, building an entirely new financial system on distributed ledger architecture - which is inherently slower and less efficient than server-client architecture - requires many additional assumptions.

However, the merger and acquisition/product developments occurring in stablecoins and cross-border payments, backed by real users, is extremely encouraging for those who believe in the vision of 'finance implemented through distributed ledgers'.

Furthermore, there are companies that strongly believe in this vision and seek to convert it into money/investment.

For example, there's Tether Limited Inc., which operates the stablecoin USDT.

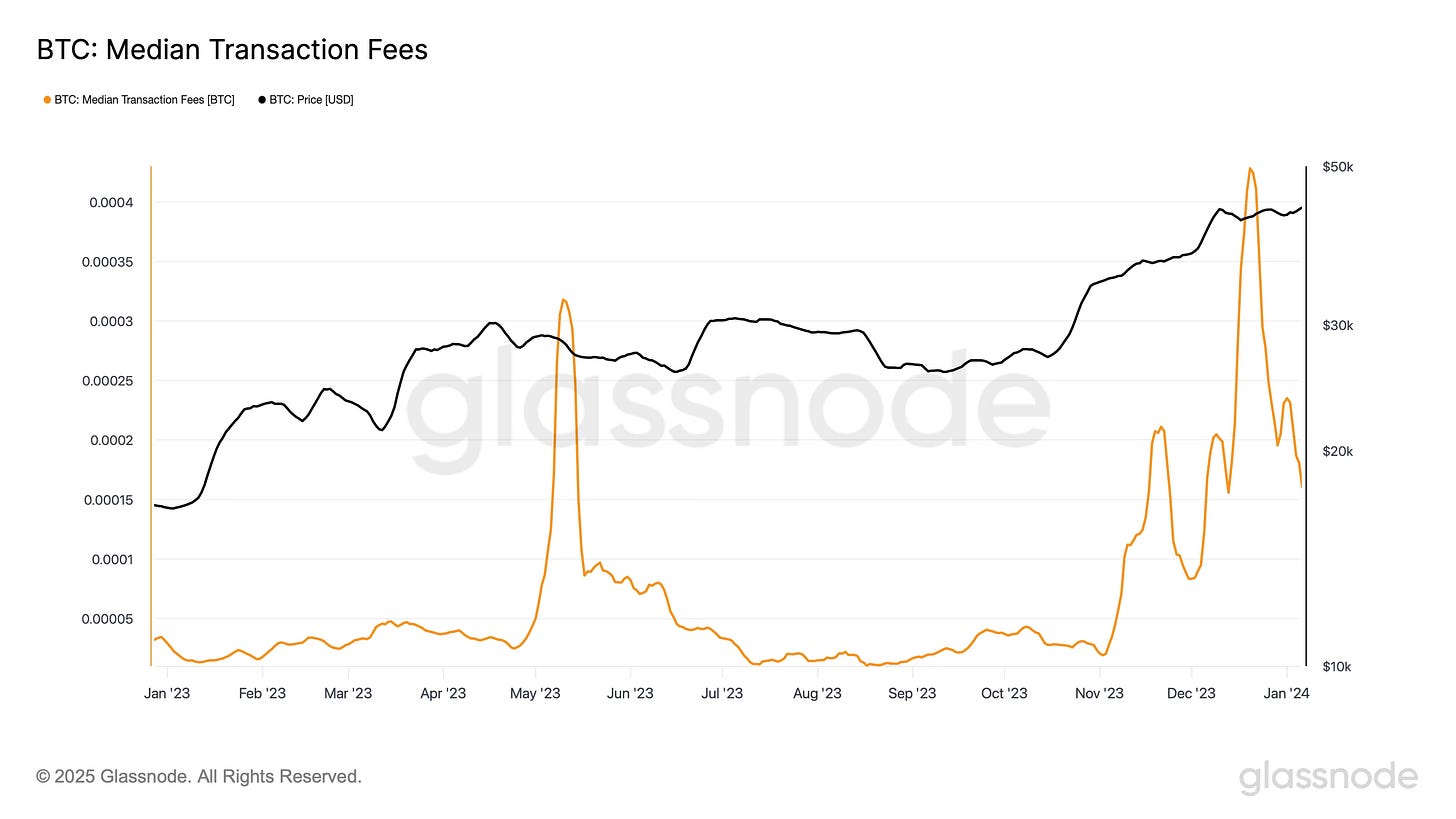

Tether, which recorded net profits of USD 6.2B (approximately 8.6 trillion won) in 2023 and USD 13.724B in 2024, officially announced in May 2023 that it would convert up to 15% of its net profits into BTC holdings.

“Starting this month, Tether will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin(BTC)”Contrary to the common notion that cryptocurrency is a risk asset, Tether stated in its announcement that holding and purchasing Bitcoin is expected to diversify and strengthen their reserves. Tether is demonstrating its strong belief in the future of finance implemented through distributed ledger technology through this financial declaration.

While there are well-known companies like MicroStrategy Inc. (MSTR:NADQ) in the US and Metaplanet Inc. (3350.T:TYO) in Japan that strategically take on debt (or capital) to purchase Bitcoin, it appears that globally, aside from Tether, there are no companies that continuously purchase Bitcoin using operational cash flow rather than as one-time purchases.

2. Dunamu’s Bitcoin Reserves and Its Revenue Sources

However, interestingly, there's a Korean company that is 'purchasing' BTC with a certain percentage of its revenue, and we don't need to look far to find it.

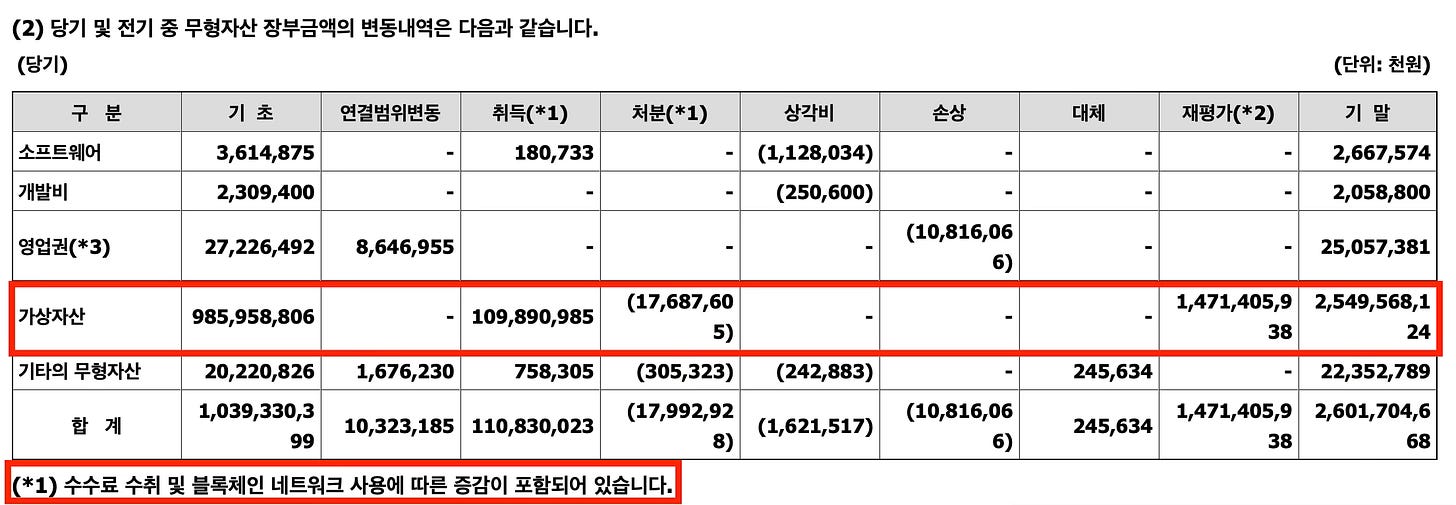

Dunamu, the operator of Upbit, is effectively 'purchasing' BTC with a certain percentage of its revenue each year. In 2024, Dunamu 'purchased' 917 bitcoins, which is 4.62% of its operating revenue (sales) of USD 1.3B, and in 2023, it 'purchased' 3,918 bitcoins, which is 13.56% of its USD 769M revenue.

As a result of this diligent accumulation each year, Dunamu's self-owned BTC holdings reached 16,839 as of the end of 2024. Though this is among listed companies, they rank 4th globally in bitcoin holdings, closely following the 3rd place (ranking 10th when including private companies).

The self-owned holdings rapidly increased from 195 BTC at the end of 2019 to 16,839 BTC at the end of 2024, a relatively short period of five years.

To understand how Dunamu has accumulated Bitcoin, we need to look at Upbit's service business model.

Upbit's basic business model is very simple. When users (1) trade cryptocurrency on the platform, Upbit receives trading fees from users in exchange for providing the service.

Additionally, there is (2) a staking service. Cryptocurrencies are committed to maintain network security and receive cryptocurrency rewards for performing various computations. Upbit performs these activities on behalf of users and receives a portion of the rewards as fees.

While overseas exchanges operate more diverse services, Upbit's token (Fungible token, FT) related services are currently limited to these two.

(1) On the trading side, Upbit operates the 'KRW Market' where Korean won can be exchanged for cryptocurrencies like 'KRW-BTC', the 'BTC Market' where Bitcoin can be exchanged for other cryptocurrencies like 'BTC-ETH', and the 'USDT Market' where USDT can be exchanged for other cryptocurrencies like 'USDT-ETH'.

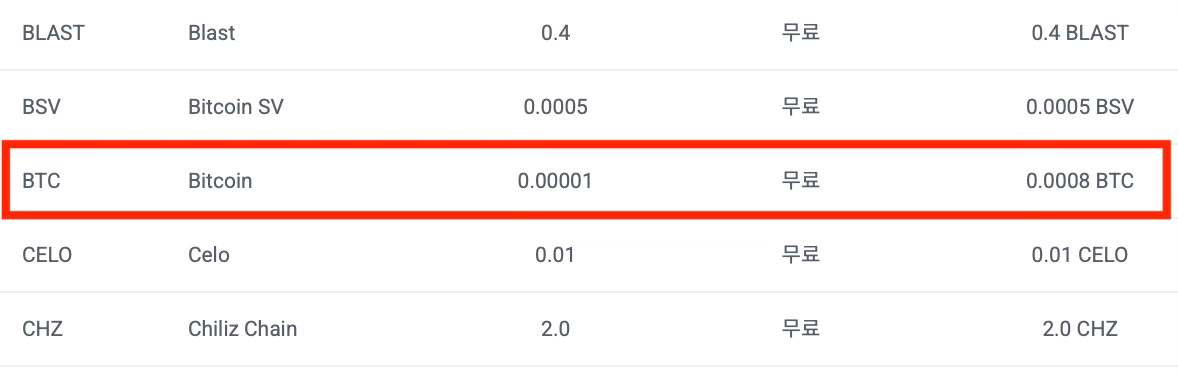

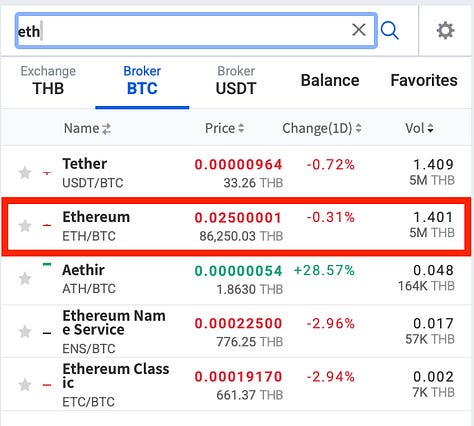

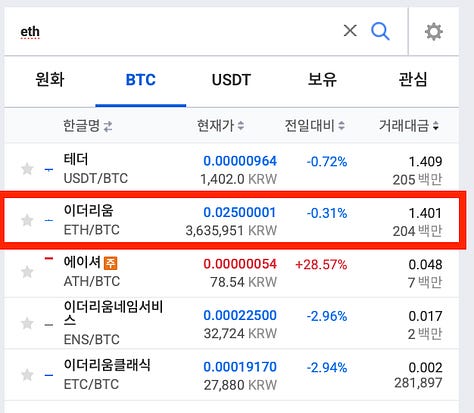

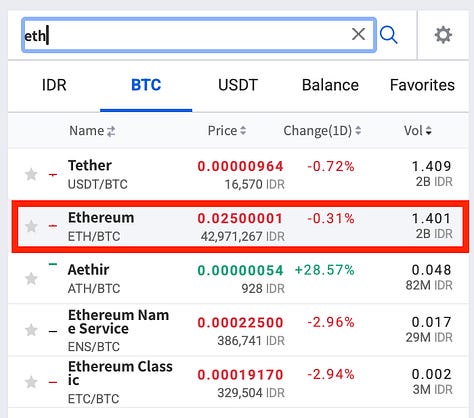

Looking at the 'BTC Market', Upbit currently (as of 05.15.2025) has 222 'BTC Markets', where they collect a 0.25% fee in BTC from both sellers and buyers for each transaction. The other markets also collect fees in their respective base currencies, such as KRW and USDT.

Additionally, while providing trading services to users, Upbit must also offer custody and deposit/withdrawal services as ancillary services. In this process, when users withdraw their cryptocurrencies from custody, the exchange collects withdrawal fees from users to pay for the network fees required on the blockchain.

For BTC, they are currently (as of 05.15.2025) collecting 0.0008 BTC as a withdrawal fee.

(2) In terms of staking, Bitcoin, being a PoW (Proof-of-Work) system, inherently has no staking concept. Furthermore, Upbit is not operating BTCfi which would utilize Bitcoin in DeFi(Decentralized Finance), nor is it conducting Lightning Network routing that could earn fees by 'staking' and operating a certain amount of Bitcoin. Therefore, Bitcoin cannot be earned through this service.

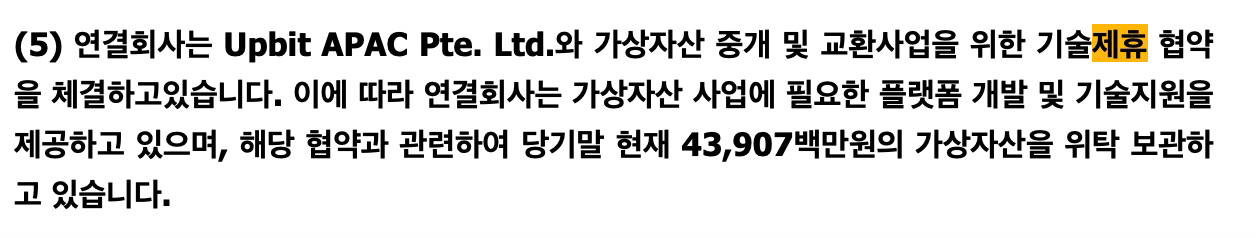

(3) While we mentioned two aspects of Upbit's service BM earlier, there is an uncertain third one: the contract providing Upbit's brand and technology to overseas virtual asset exchanges.

Dunamu has disclosed through its business report that it has a technical alliance agreement with Upbit APAC Pte. Ltd. Although specific contract terms are not public, they share BTC market orderbooks (Upbit Singapore discontinued orderbook integration as of September 30, 2021), suggesting the possibility of receiving Bitcoin through this source depending on contract terms.

While specific conditions cannot be found, Upbit Thailand's 2024 year-end business report shows payments to Dunamu Inc. for 'System service expenses' as the main transaction with 'Business Alliances'. This suggests the possibility of fee transfers from BTC markets.

I examined whether this trading volume should be considered significant or negligible (de minimis) for estimation purposes. Thailand has the same 0.25% fee rate (0.5% total), but Indonesia has a 0.51% fee rate (1.02% total), so if trading volume is high, it would need to be actively considered in estimates.

When comparing the daily BTC market trading volume for Thailand/Indonesia against Korea, it appears to be aggregated together, making it impossible to determine specific contributions from each.

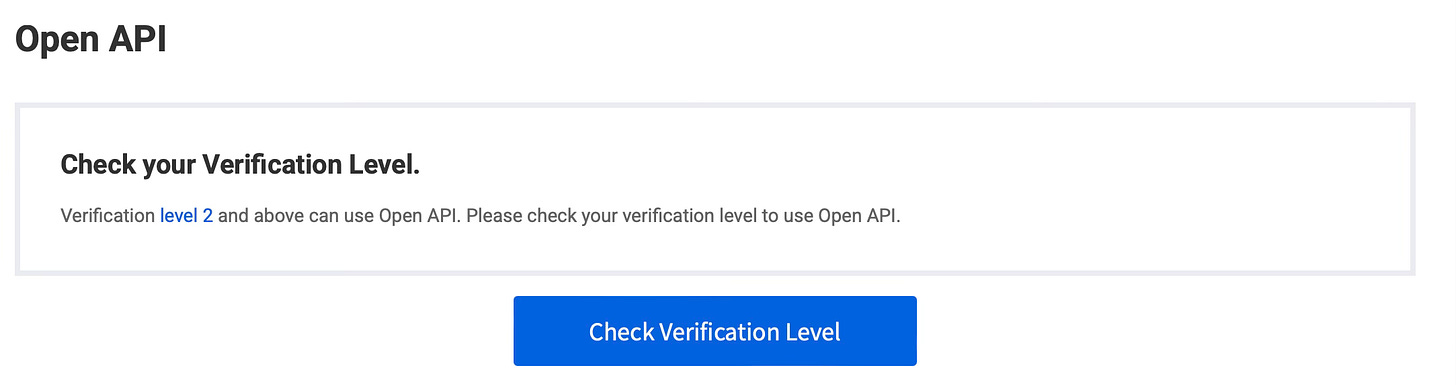

When I tried to determine the contribution through API calls, it became too cumbersome with KYC requirements and such, so I used alternative methods.

Looking at Thailand first, they recorded operating revenue of 47,421,955 Baht in 2024. Given that the THB/KRW exchange rate didn't show significant fluctuations throughout 2024, using an average exchange rate seems reasonable.

Therefore, at an exchange rate of 38.68 THB/KRW, Upbit Thailand's operating revenue for 2024 amounts to approximately USD 1,358,758. While most of the revenue likely came from BTC pairs since Upbit Thailand only has 21 THB pairs, this still wouldn't represent a significant amount of Bitcoin for Dunamu (less than 10 BTC).

As for Indonesia, unlike Thailand, they don't appear to have mandatory business report/financial statement disclosure requirements. Looking at Upbit Indonesia's Bitcoin IDR trading volume, it only shows about three times the volume of Thailand, so this too likely won't have a significant impact.

Looking at Upbit's business model this way, we can see that Bitcoin can be acquired as revenue from three sources:

(1) BTC trading fees from the 'BTC market',

(2) BTC withdrawal fees collected when users withdraw BTC,

(3) (Uncertain) BTC fees that could be earned through contractual relationships with Upbit APAC

When expressed in accounting terms, the following transaction occurs at every revenue recognition point from user trades/withdrawals/contracts:

Since Bitcoin becomes Dunamu's property, it is recorded as an asset, and the reason for receiving Bitcoin is explained as company revenue.

(Dr) Intangible Asset(BTC) XXX / (Cr) Revenue XXXMeanwhile, if we split the above entry into two identical ones, couldn't we say that through trading fees and withdrawal fees, Upbit is essentially 'purchasing' BTC through DCA (Dollar-cost averaging) every second1 when trades/withdrawals occur?

(Dr) Accounts Receivable/Cash XXX / (Cr) Revenue XXX(Dr) Intangible Asset(BTC) XXX / (Cr) Accounts Receivable/Cash XXXViewed this way, Dunamu has 'purchased' Bitcoin worth approximately 80 billion won (4.62% of USD 1.3B in operating revenue) in 2024, and USD 769M (13.56% of 1 trillion won) in 2023.

3. Future Outlook for Upbit’s BTC DCA

Two questions arise here:

(1) In what proportion does Upbit reflect 'BTC market fees' and 'withdrawal fees' (and if any, contract fees) in their revenue?

(2) And can Upbit, which has rapidly accumulated Bitcoin to become global top 10 holder, continue to increase its holdings at this rate from these two sources?

Since business valuation typically uses cash (DCF) rather than income statement figures like revenue that can vary between periods due to accrual accounting, these two questions about Bitcoin - which is reflected in revenue but isn't cash - appear to be important factors in Dunamu's business valuation.

(As a side note, this article actually started because I was finally able to move my Bitcoin from another domestic exchange to an overseas exchange after not being able to use exchanges and on-chain for 3 years due to my work in Upbit. Since it was my first time using on-chain in a very long time, I was going to do a penny test to avoid mistakes, but when I saw the withdrawal fee of 0.0008 BTC, I decided to move it all at once, which led me to write this research article after a very long time.)

Regarding the first question, while we could distinguish between (1) BTC market fees, (2) BTC withdrawal fees, and (3) contract fees in various ways, since this is my first research in a while, I decided to examine the following three methods to use both off-chain and on-chain data extensively:

Using off-chain data (financial statement notes on BTC acquisition + Upbit Openapi usage)

Using off-chain + on-chain data (financial statement notes on BTC disposal + on-chain average tx fee usage)

Using on-chain data (using the sum of satoshis from UXTOs used in Upbit labeled wallet addresses)

For the second question, we'll examine it using the figures obtained while looking into the first question.

3.1 Using off-chain data (financial statement notes on BTC acquisition + Upbit Openapi usage)

(3.1.1) Review of Additional Acquisitions

Based on the above consideration of Upbit's business model, we have examined the areas where Upbit can acquire Bitcoin.

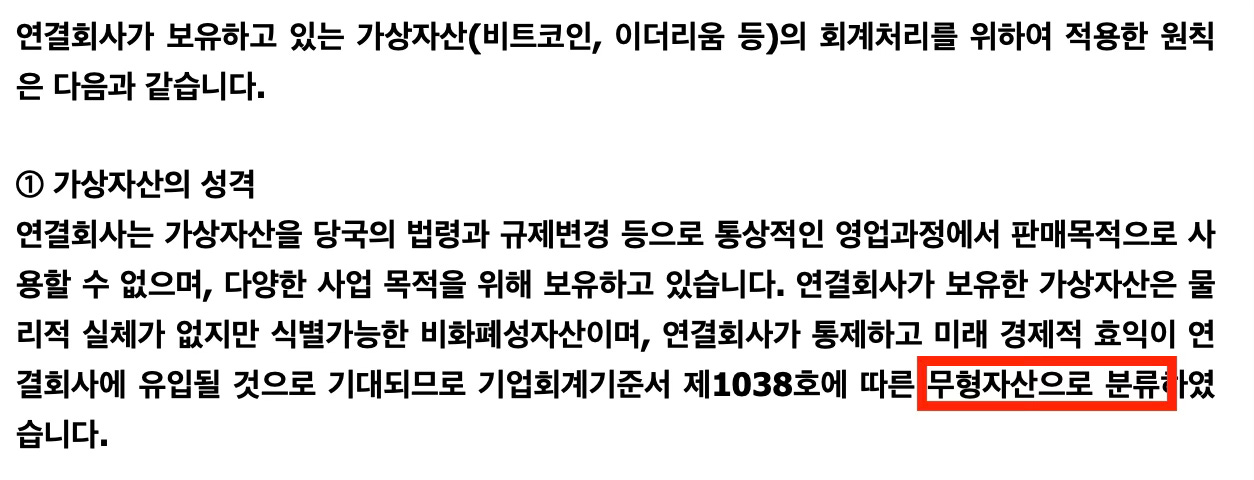

However, we can look for additional acquisition-related information in the business report issued by the company. Financial statements contain notes, which provide more detailed explanations of the various numbers presented. Upbit has a policy of defining Bitcoin and other virtual assets (hereinafter 'cryptocurrencies') as 'intangible assets'.

Looking at the intangible asset notes that explain these intangible assets in more detail, it states that regarding new cryptocurrency acquisitions, "changes due to fee collection and blockchain network usage are included." Since this implies that there may be cryptocurrency acquisitions from sources other than trading fees or withdrawal fees (blockchain network usage), we need to carefully examine other items in the financial statements for completeness of analysis to see if there are acquisitions from other sources.

For assets like intangible assets(Bitcoin) to increase, there must always be a reason. If I conduct business and someone happily gives me Bitcoin in return for services I provided, this can be explained as revenue.

Besides service provision, the most common method is buying Bitcoin with cash. Also, like MicroStrategy Inc., you can acquire Bitcoin by taking on debt/capital. Alternatively, you can receive Bitcoin as consideration for giving away rights to own the company, or finally, you can acquire Bitcoin by exchanging other assets you own.

For cash-involved cases, this can be examined in the cash flow statement of the financial statements, while non-cash transactions involving exchanges with other liabilities/equity/assets can be examined through notes related to non-cash transactions or the statement of changes in equity.

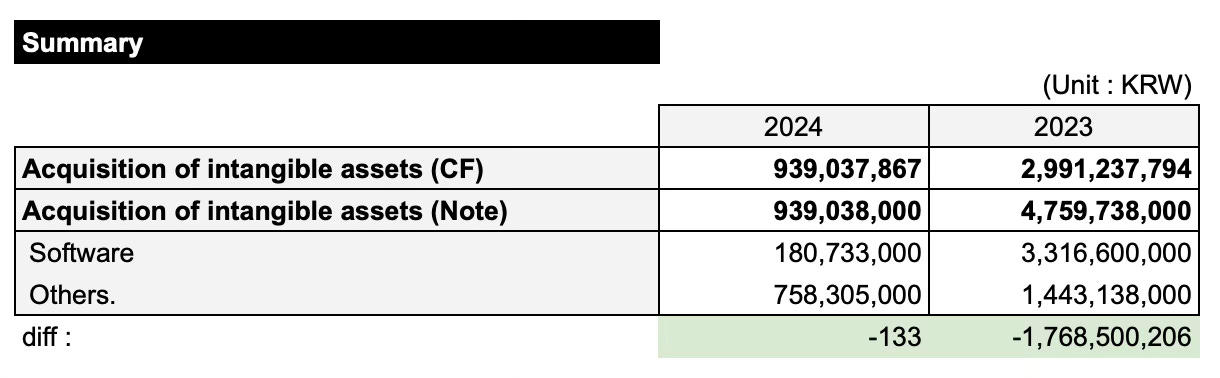

No separate intangible asset-related items were found in the statement of changes in equity. Regarding intangible asset acquisition expenditures in the cash flow statement, the 2024 figures match the software acquisition and other intangible asset acquisition amounts, indicating no separate acquisitions, while in 2023, it appears there was some cryptocurrency acquisition worth about 1.7 billion won in cash. This amount seems insignificant for our analysis and can be disregarded.

With no other notes on non-cash transactions, it seems reasonable to limit cryptocurrency acquisition sources to (1) BTC market fees, (2) BTC withdrawal fees, and (3) contract fees (uncertain), excluding the insignificant 2023 transaction.

(3.1.2) Calculation of BTC Market and Contract Fees

Currently, we are trying to determine Dunamu's Bitcoin acquisition ratio/number from each source. If we can determine these ratios/numbers, we can roughly predict future figures as well.

Since acquisitions are not directly categorized by source in the financial statements, we can get some idea about withdrawal fees by calculating the total annual fees from the BTC market and subtracting these fees from the BTC acquisition numbers stated in the financial statements2.

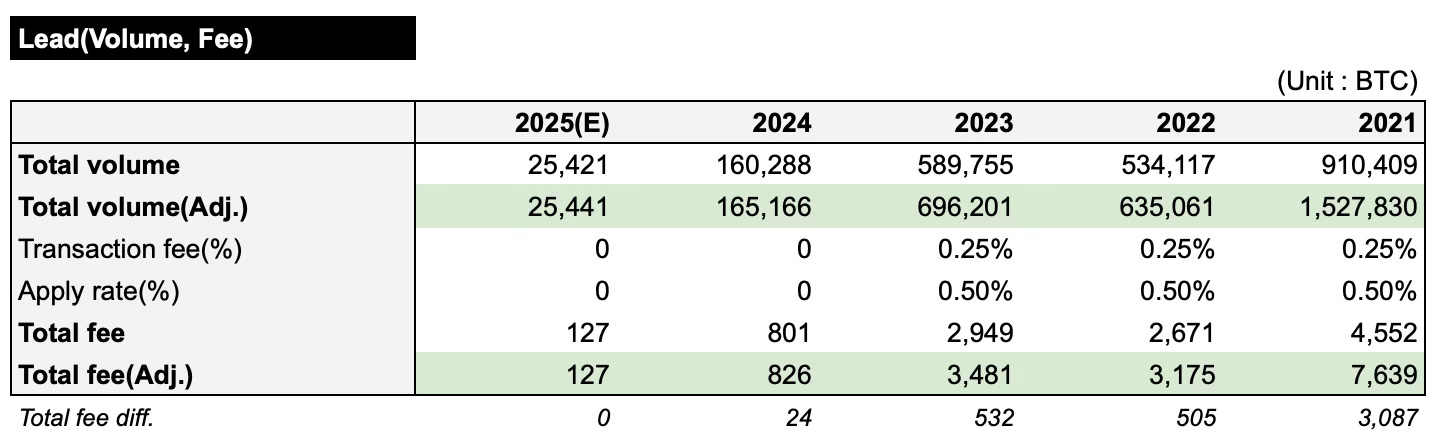

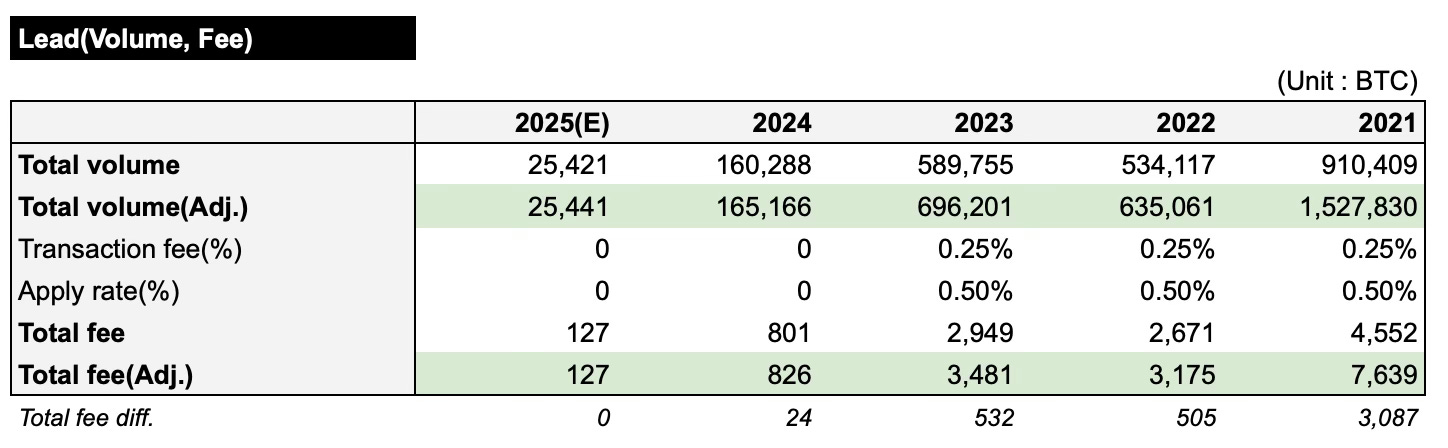

The BTC market trading volume and total fees for each year extracted using the Upbit OpenAPI are shown in the table above.

For the Upbit API, various data related to daily and weekly candles can be retrieved from https://api.upbit.com/v1/candles/days.

We retrieved the BTC market trading volume using the 'candle_acc_trade_price' function after setting it to daily candles. If trading volume is calculated using 'candle_acc_trade_volume' and multiplying by 'trade_price', note that since 'trade_price' retrieves closing price data, this can lead to under/overestimated data as price volatility increases.

Additionally, while the Upbit API continuously reads previous ticker data for cryptocurrencies with changed tickers (rebranding, etc.), it does not provide any past or current data for cryptocurrencies that have been delisted (returns 404 when called).

Consequently, especially for earlier years, as the cumulative omission of trading volume for delisted cryptocurrencies increases, BTC market trading fees become severely underestimated. Therefore, for already delisted virtual assets3, we applied the average value of cryptocurrency trading volume for that year as a baseline, and for assets delisted during the period4, we used the trading volume at the 95th percentile as a proxy5, reflecting Korean market characteristics6, and multiplied by the number of delisted assets considering the period to adjust the total trading volume.7

(3.1.3) Calculation of 'BTC Withdrawal Fee' Revenue

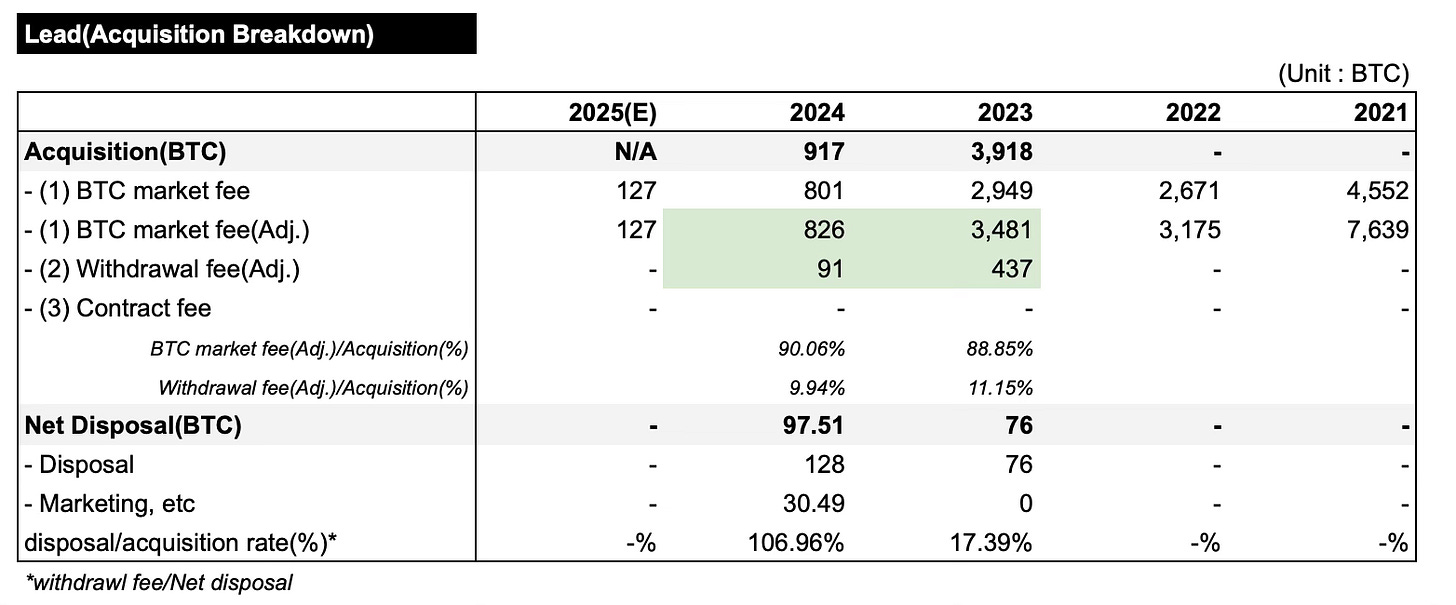

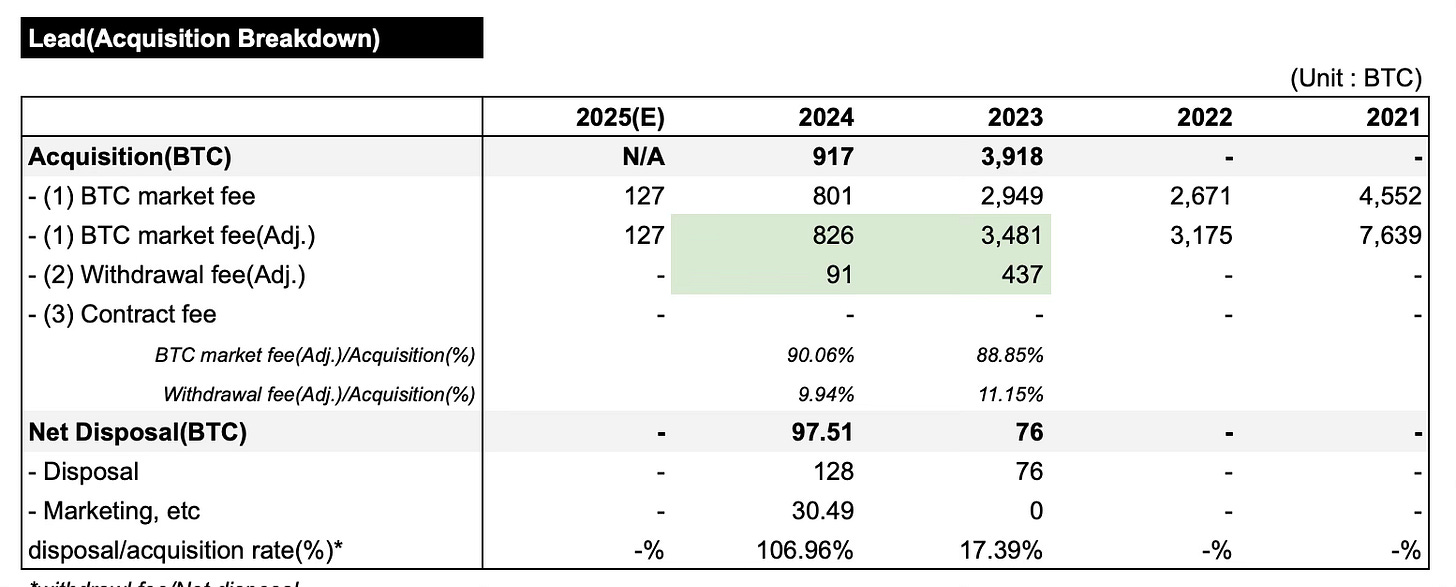

Unlike 2021 and 2022 where acquisitions and disposals were offset, for 2024 and 2023 where BTC acquisition numbers are available in financial statements, our estimates show that Upbit collected 91 BTC in withdrawal fees in 2024 and 437 BTC in 2023.

In 2024, out of 917 BTC acquired, 826 BTC came from the BTC market, meaning 91 BTC came from withdrawal fees. In 2023, out of 3,918 BTC acquired, 3,481 BTC came from the BTC market, suggesting 437 BTC came from withdrawal fees.

For 2024, the net disposal (97.51 BTC) excluding marketing-related BTC consumption exceeds the Bitcoin earned from withdrawal fees (91 BTC), suggesting either an overestimation in BTC market fee calculations or that Upbit used Bitcoin elsewhere.

Conversely, while 2023's ratio of net disposal to withdrawal fees at 17.39% seems reasonable, considering the withdrawal fee of 0.0009 BTC per transaction in 2023, this would mean 1,330 daily withdrawals on average, implying more than one withdrawal per minute throughout the year, which seems unrealistic.

Therefore, it would be more reasonable to assume that Dunamu's actual annual BTC withdrawal fee revenue lies somewhere between the band of 91-437 BTC calculated from trading fees and the more realistic withdrawal frequency band of 79-157 BTC based on 10-20 withdrawals per hour.

How profitable is the withdrawal fee business?

Setting aside our previous analysis and comparing the typical on-chain gas fees visible in block explorers (e.g., 220 sats, 0.0000022 BTC) with the current withdrawal fee of 0.0008 BTC, we can see that exchanges achieve over 99.7% profit margins.

This aligns with withdrawal fees at competing international exchanges. In highly competitive conditions, they tend to charge customers only minimal fees to cover costs. (While still preventing Sybil, of course)

Given that user withdrawal frequencies are limited and this isn't a scalable area, there's no need to generate significant revenue here. Looking at random international exchanges, MEXC charges 0.00001 BTC for Bitcoin withdrawals, OKX charges 0.00002 BTC, and Binance charges 0.00003 BTC.

However, when calculating the cost of any product/service, multiple factors need to be considered. Even in cooking, one must decide whether to include just ingredient costs, gas bills, or even depreciation of equipment like knives - there are numerous considerations.

The hot and cold wallet management system for deposits and withdrawals represents each exchange's competitive edge and policy choices regarding user efficiency and security. Beyond personnel and infrastructure costs, network fees are incurred in various operations including Bitcoin collection and hot/cold wallet ratio adjustments.

The 82.61% profit margin calculated for 2023 can be considered the exchange's profit margin after accounting for all these network fees.

In fact, according to Dunamu's Q1 2025 quarterly report released on May 15, showing 47 BTC acquired and 16 BTC disposed over three months, applying the 17.39% acquisition ratio to net disposal (8.2 BTC) yields 47.15 BTC, strongly supporting our 2023 estimate of 17.39%.

(3.1.4) Summary

We've examined Upbit's Bitcoin acquisition sources, focusing on BTC market trading fees.

First, the withdrawal fee business shows 98-99% profitability when considering only network withdrawal costs. However, actual profit margins considering all costs are likely below 82.61%.

Additionally, since user withdrawals are limited, the withdrawal fee business isn't a scalable business model. With withdrawal fees estimated between 91-437 BTC annually based on trading fees, actual profits considering all costs are unlikely to exceed 100 BTC per year going forward.

Looking at trading fees, after recording a historic 1,527,830 BTC trading volume in 2021 (all figures estimated), volumes stabilized at 635,061 BTC and 696,201 BTC in 2022 and 2023 respectively, before sharply declining to 165,166 BTC in 2024.

This trend continues into 2025. As of May 15, 2025, only 9,410 BTC in trading volume has been recorded, which annualized amounts to just 25,441 BTC, generating only 127 BTC in fees(before cost).

Without measures to support the BTC market, Upbit likely won't be able to accumulate significant BTC through trading fees as it did in the past. With Bitcoin widely recognized as a Store of Value since the Spot ETF launch, users may be hesitant to engage in markets using BTC as fees.

Indeed, coincidentally, trading volume has dropped 72% (564,479 → 158,762) since the spot ETF approval in January 2024. While Dunamu seems aware of this, having attempted fee reductions that did impact volume, the long-term profitability of the BTC market needs careful consideration.

3.2 Using Off-chain + On-chain Data (Financial Statement Notes on BTC Disposal + Average On-chain tx fee)

(3.2.1) Review of Additional Disposals

When a customer requests a withdrawal from an exchange, the exchange deducts the requested BTC amount from the customer's DB and prepares a bitcoin transaction to reflect this withdrawal on the bitcoin network.

The exchange includes the customer's requested address in the bitcoin transaction's vout field, signs it with the controlling wallet's private key, and broadcasts the transaction through nodes distributed worldwide. During this process, a certain fee is included in the transaction to ensure inclusion in the bitcoin network's blocks.

To successfully complete a transfer on the bitcoin network, sufficient fees are required to make the transaction attractive enough for miners to include in blocks, which is why exchanges charge withdrawal fees to users.

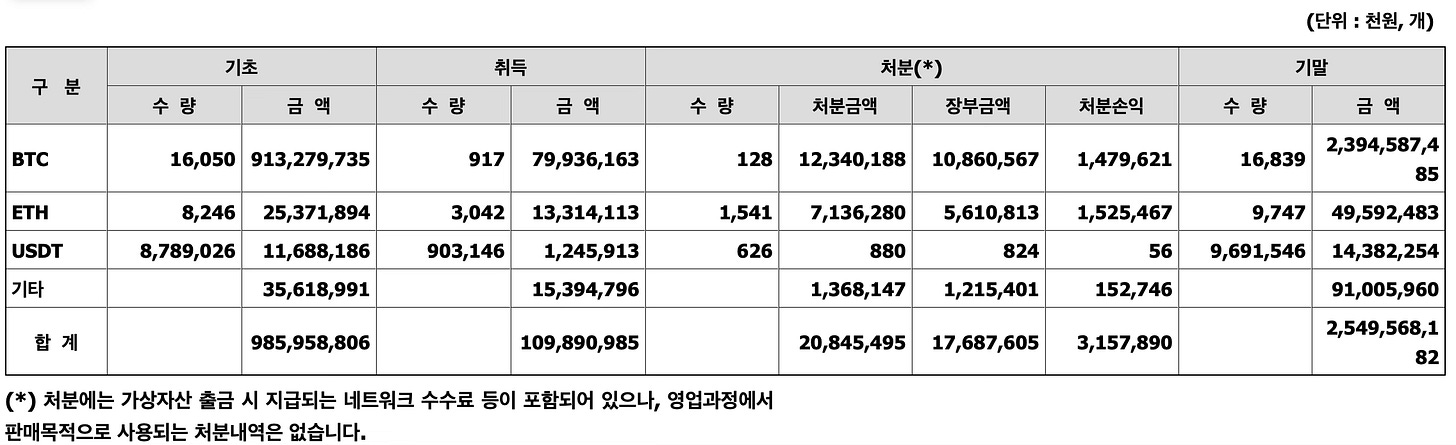

Given that exchanges both collect withdrawal fees from users and pay network fees as disposal pairs, we can calculate specific withdrawal numbers by analyzing these network fee disposals. This can be calculated by dividing the total BTC disposed by the average transaction BTC fee.

However, we need to examine whether the BTC disposal amounts stated in the financial statements might include BTC disposed for purposes other than network fees.

Looking at the notes regarding disposals, it states "Disposals include network fees paid during cryptocurrency withdrawals, but there are no disposal records used for sales purposes in business operations." While this explicitly states no disposals for sales purposes in operations, it leaves room for other possibilities.

However, we developed a hypothesis questioning whether BTC would be used for purposes other than marketing and calculated based on this.

(3.2.2) Marketing BTC Usage and Network Disposal BTC Amounts

BTC marketing was non-existent in 2023 but significantly increased to 14 instances (30.49 BTC) in 2024.

Based on the hypothesis that disposals would only be for marketing purposes, network fee disposals can be estimated at 76 BTC for 2023 and 97.51 BTC (=128-30.49) for 2024

(3.2.3) Annual Average Withdrawal Fees

Now, by determining the annual average withdrawal fee, we can calculate approximately how many withdrawal transactions occurred based on the disposed BTC amount.

The withdrawal fees collected by Upbit are calculated by multiplying these transactions by 0.0008 or 0.0009 BTC8.

For annual average withdrawal fees, we explored various data sources but found them either incomplete or requiring expensive subscriptions for CSV/JSON data extraction, so we had to use GPT to calculate average values from graphs.

The figures are 0.0000269 BTC for 2023 and 0.000086 BTC for 2024.

<2023>

<2024>

Looking at on-chain records, regular withdrawal transactions typically show fee payments within these ranges.

(3.2.4) Summary

However, the withdrawal numbers calculated using the above average fees are 2,825,279 transactions (=76/0.0000269) for 2023 and 1,133,837 transactions (=97.51/0.000086) for 2024. This translates to 3,106 and 7,740 daily transactions respectively, which seems too high for user withdrawal numbers.

Additionally, according to Arkham, where most Upbit BTC addresses are labeled, external withdrawals from Upbit vary significantly between 3-15 transactions per hour.

Contrary to our hypothesis, it's likely there are other contracts using BTC besides marketing, along with significant fees consumed in exchange operations such as transferring from user addresses to hot wallets and between cold and hot wallets for management purposes.

Therefore, without direct compilation of these amounts on-chain, accurate estimation using method 2) appears impossible.

The values obtained through this method show numerous errors, aside from differences with method 1).

Initially, high network fees indicate high network usage, and (excluding exceptions like inscriptions and BRC-20) Upbit's bitcoin withdrawal requests are likely to occur more frequently during expensive periods, suggesting structural overestimation of bitcoin withdrawal request numbers.

Additionally, fees used in collection processes are unrelated to withdrawal frequency but are included in disposals, revealing this method's limitations upon reflection.

In any case, determining withdrawal fee profitability using BTC disposals from financial statements and average on-chain fees appears challenging.

3.3 Using On-chain Data (Using the Sum of Satoshis from UTXO Used in Upbit's Labeled Wallet Addresses)

This final method considered is theoretically the most accurate approach.

When a customer requests a withdrawal, the exchange must leave a transaction on the network. (In the future, I think large institutions/exchanges might use off-chain settlement transactions to save fees and improve customer convenience)

Accordingly, if we could secure most of Upbit's BTC cold/hot wallet addresses, we could calculate the sum of satoshis used as fees when consuming UTXOs held by these addresses between specific blocks through a full/archive node.

This sum would represent the amount of BTC used for 'disposals' in that year, and the number of outputs, excluding those returned to Upbit wallets, would indicate the number of withdrawals for calculation. Additionally, we would need to exclude the numerous internal exchange transaction substitutions.

(3.3.1) Upbit's Labeled Wallet Addresses

As of the end of December 2024, the financial statements show Upbit's holdings of 16,839 and customer asset holdings of 160,241, totaling 177,080.

While there might be some incremental changes over five months, Arkham shows a figure of 174,791 BTC. There's a difference of 2,289 (about 330 billion won, 1.3%), but this 1.3% difference could be considered negligible.

Given the characteristics of user wallets with movements + emphasis on separate storage, it seems the cold wallets might have been less detected.

However, naturally, since Arkham doesn't provide these wallet addresses in bulk, we would have to collect them manually, so we couldn't directly calculate using this method.

Even looking at alternative platforms like Nansen, there don't seem to be any providers offering this information, even for a fee. These pieces of information are likely high-grade intelligence that forms the competitive advantage of intelligence platforms, so they naturally wouldn't provide it in bulk. We should be grateful that they show even some of it for free.

(3.3.2) Summary

Therefore, since we couldn't track all of Upbit's wallet addresses, we unfortunately couldn't calculate the profitability of withdrawal fees using this method either.

4. Conclusion

Having observed that Upbit has accumulated a significant amount of Bitcoin through DCA, holding 16,839 BTC as of December 2024, I examined the following two critical questions for proper enterprise value assessment of Dunamu:

(1) What proportion of revenue does Upbit attribute to BTC market fees versus withdrawal fees?

(2) Now that Upbit has grown its Bitcoin holdings to 4th place globally (among listed companies), can it continue to increase holdings at this rate from these two sources?

4.1 What proportion of revenue does Upbit attribute to BTC market fees versus withdrawal fees?

Based on estimates for 2023 and 2024, withdrawal fees account for less than 10% of total acquisitions, making their contribution limited. BTC market fees constitute over 90%, representing the majority of Dunamu's Bitcoin DCA. While there appears to be correlation between these two factors, withdrawal fees still have room for growth, as we'll examine below.

4.2 Now that Upbit has grown its Bitcoin holdings to 4th place globally (among listed companies), can it continue to increase holdings at this rate from these two sources?

Analysis reveals that unless Dunamu directly purchases BTC with cash, it's clear they won't be able to accumulate BTC at the same rate as before.

The BTC market trading volume was 696,201 BTC in 2023, showing a slight increase from 2022. However, after the Bitcoin Spot ETF approval in 2024, volume dropped dramatically by 72% to 165,166 BTC. Currently in 2025, the annualized volume is projected to be 25,362 BTC, representing a 96.4% decrease from 2023. This can be interpreted as users refusing to use BTC for altcoin trading now that Bitcoin is recognized as a Universal Store of Value following the spot ETF.

Withdrawal fees have also been gradually reduced from 0.001 BTC → 0.0009 BTC → 0.0008 BTC, but compared to global exchanges' withdrawal fees (e.g., OKX 0.00002 BTC, Binance 0.00003 BTC), there's a difference of about 40x for mainnet and 800x for Lightning Network, suggesting significant downward pressure on withdrawal fees in the future.

Considering exchange operating fixed costs, rather than arbitrarily lowering withdrawal fees, they should be reduced based on expanding the customer base (globally) and securing new services (Perp, Option, Lending, etc).

Given these circumstances, regardless of current withdrawal fees, they are likely to eventually decrease to a level that merely compensates for network transaction fee costs. (This could be dynamic)

Additionally, attention should be paid to Dunamu's future policies. It's still unclear whether Bitcoin DCA was intentional or if they were forced to hold due to regulatory restrictions on corporate accounts.

Regardless of intentions, Dunamu has essentially been operating like a Bitcoin maximalist, using a significant portion of revenue to 'purchase' BTC, which has proven to be a successful investment.

Moreover, considering they likely paid value-added tax in KRW on Bitcoin-earned operating income due to disposal restrictions, they've effectively been acting like an extreme Bitcoin maximalist who preferred to save their Bitcoin and pay taxes in cash. Until now, that is.

However, disposal restrictions have now significantly decreased. As of early 2025, both law enforcement agencies and crypto exchanges can dispose of cryptocurrencies, so this should be closely monitored from 2025 onward.

Here are the conclusions of this analysis :

Upbit, operating as a Bitcoin maximalist, has rapidly accumulated Bitcoin through DCA using 'BTC market fees' and 'BTC withdrawal fees' as sources, holding 16,839 BTC as of December 2024. This amounts to approximately USD 1.8B, ranking 4th globally among listed companies and 10th including private companies.

However, due to the structural decline in BTC market trading volume resulting from Bitcoin's strong sentiment as a 'Store of Value' and the expected decrease in withdrawal fee profitability due to exchange competition, Dunamu is not expected to accumulate Bitcoin at the same rapid pace as before.

As regulations become clearer with the gradual allowance of corporate accounts, Bitcoin disposal is becoming more flexible, suggesting that Dunamu's Bitcoin strategy may change, warranting close attention.

From a valuation perspective, here are additional comments :

While there are many articles about Dunamu's operating and net profit, there are few about their Bitcoin holdings, and no articles discussing Upbit's Bitcoin-related revenue structure. This factor may have been overlooked in market valuations (Not Financial Advice)

The USD 1.1B increase in capital from revaluing intangible assets (Bitcoin) at the end of 2024 isn't reflected in operating/net profit and might be missed by retail investors. This appears not to be reflected in the current market cap of USD 3.9B when considering adjusted PER. While Coinbase might not be an appropriate comparable company for Dunamu due to Coinbase's diverse business areas including mainnet (Base), options (Deribit), and planned US futures market entry extending beyond Upbit's scope, the difference in adjusted PER between the two companies, considering Bitcoin holdings, could be a factor to consider for investment.

However, it's also evident that Dunamu cannot continue accumulating Bitcoin at the same rate as they've accumulated 16,839 BTC in reserves so far, so caution should be exercised against placing excessive value on future Bitcoin holdings in Dunamu's valuation.

End of the article.

Linkedin : www.linkedin.com/in/renjang Twitter : https://x.com/Renorai_ Telegram : https://t.me/rentestnet

According to Dunamu’s accounting policies, the company applies a monthly average pricing method when recognizing unit costs. Therefore, the book value of Bitcoin is not tracked on a per-second basis, as would be the case with strict DCA.

Since the detailed terms of the agreement with Upbit APAC are unknown, we proceed under the assumption that this component is not materially significant.

For example, when calculating trading volume for 2023, Coins delisted in 2024 are completely omitted from the 2023 annual trading volume.

For example, when calculating trading volume for 2023, Coins delisted during 2023 are partially omitted, with volume missing from the month of delisting onward.

We applied a 50% adjustment factor, based on the assumption that there was a fundamental shift in sentiment after 2024.

The Korean market has a unique characteristic where trading volume tends to spike immediately following announcements of investment warnings or delistings.

For more detailed estimation methodology and source data, please refer to: https://docs.google.com/spreadsheets/d/10vOJjDJNuLLGAbBLHlXfmNShewv9Czvd7RhQ9eSRI7Q/edit?gid=1992666012#gid=1992666012

Upbit adjusted its BTC withdrawal fee from 0.0009 BTC on May 20, 2020 to 0.0008 BTC on May 22, 2024.